Qlik adquiere Attunity

February 27, 2019

By: Stewart Bond, Chandana Gopal

IDC's Quick Take

On February 21, 2019, Qlik announced it has entered into a definitive agreement to acquire Attunity Ltd.

Qlik is acquiring Attunity to further develop its data platform and become a comprehensive end-to-end provider of data management and business analytics solutions.

M&A Announcement Highlights. On February 21, 2019, Qlik announced it has entered into a definitive agreement to acquire Attunity.

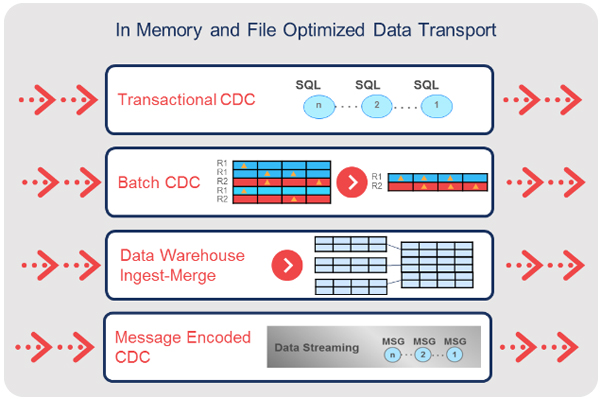

Under the terms of the agreement, Qlik will acquire all outstanding ordinary shares of Attunity for a total value of approximately $560 million. Attunity shareholders will receive $23.50 in cash per share, representing an 18% premium to Attunity's last closing price of $19.93 per share on February 20, 2019. The agreement was unanimously approved by the boards of directors of Qlik and Attunity. Attunity has a range of products and capabilities focused on data movement and automation, including data replication, near-real-time data delivery, data warehouse automation, and managed file transfer, within and beyond hybrid and multicloud corporate IT environments. Attunity also has a robust set of capabilities focused on SAP environments, providing SAP test data management, SAP HANA data integration, delivery of SAP data to analytics platforms, and attaining GDPR compliance.

Qlik originated as a self-service business intelligence vendor but has since expanded its offerings to become a data management and analytics platform, and its acquisition of Attunity is another step toward becoming an end-to-end fully featured platform. Qlik has made strategic acquisitions over the past two years including those of Podium Data in 2018, which added data curation, preparation, and intelligence capabilities to the Qlik portfolio in the now branded Qlik Data Catalyst product, and Crunch Data in 2019, to help increase data's value through conversation-driven interactions.

IDC's Point of View Qlik's acquisition of Attunity is positive for both companies. Qlik investors obviously see a bright future in the data platform because the Attunity acquisition wasn't a bargain buy. Attunity posted 2018 over 2017 revenue growth rates of 42% in a highly competitive market, paying shareholders an 18% premium; Qlik chose Attunity for its established user base, its strong product portfolio, and go-tomarket expertise in data integration, so that it could accelerate the move toward having a comprehensive data platform offering in the market. The Attunity acquisition also helps Qlik with its cloud story, adding capabilities in its portfolio for data replication to and from cloud data warehouses.

Like the ancient Greek philosopher Heraclitus said, "The only constant is change." When application functionality was put first, data was something the applications created or used; many point solutions were in the market until enterprise resource planning (ERP) suites entered the market, providing integrated application functionality across multiple business processes. Similarly, business intelligence (BI) has seen its share of change. For many decades, enterprises invested heavily in building data-©2019 IDC #lcUS44890719 2 related assets like database management systems, data warehouses, and big data stores and BI applications were deployed to report on enterprise data. These BI tools were complicated and required BI specialists or IT staff to create new reports and dashboards for business users. The BI market was disrupted when self-service BI tools started to gain traction because business analysts were no longer dependent on specialists to build reports. The pendulum swung from tightly controlled, centralized BI to decentralized and often ungoverned BI deployments with limited data management capabilities.

In this new era of digital transformation, data is first, driving new applications, processes, and business models. Enterprises have realized that effective decision making must be data driven and users at all levels of the organization need access to timely and trustworthy data and easy-to-use analytic tools that allow them to get insights based on that data. Point solutions and best-of-breed data applications such as business intelligence, data preparation, data integration, data curation, and data intelligence are no longer adequate, and the resulting trend is the emergence of end-to-end data management and analytics platforms that provide intuitive user experiences that truly improve data literacy among organizations.

Qlik's acquisitions of Podium Data and Crunch Data and now the agreement to acquire Attunity are positioning Qlik as an emerging data platform that not only will challenge best-of-breed and point solutions but also position it as a provider of a system of insight that is usable by all knowledge workers without compromising on integrity, governance, and security. Qlik is also embedding artificial intelligence and machine learning into its platform to automate data preparation and data visualization, to enhance user experience and broaden its user base.

Qlik has invested in developing a strong ecosystem of partners that have created value-added offerings on the Qlik platform using its open APIs. Qlik and Attunity have been aggressively partnering to meet the demands of the platform and have already demonstrated integration in the marketplace. Qlik also has an opportunity to define new use cases and patterns as the product lines become integrated, applying analytics to data intelligence, movement, and automation while bringing these same capabilities to analytics.

It is to be noted that Qlik is not the only data-oriented software vendor investing in a data platform play. Large multiproduct software companies (including those that also have a stake in ERP markets) are also making a move toward data platforms, and many self-service BI vendors are expanding their data management capabilities. Similarly, software vendors traditionally aligned with database management technologies are investing in data integration and intelligence capabilities, and data and application integration software vendors are also investing in new capabilities that expand their offerings into broader data platforms with some visualization capabilities. Data management and business analytics are increasingly overlapping, growing the competition for market share.

Leave a Comment